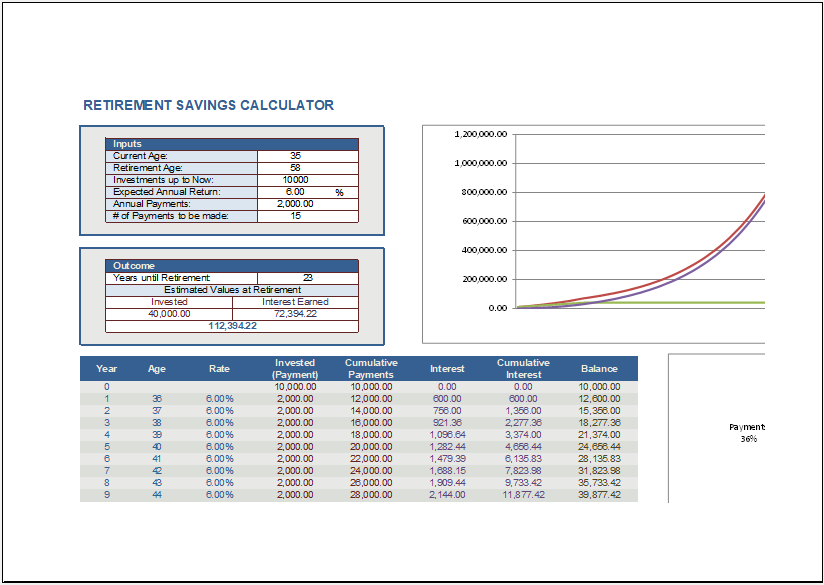

Saving and investing now means letting compound interest work in your favor in the long run. It’s never too early or too late to begin saving if you are just starting out, focus on saving as much as possible now.

How Can I Improve My Retirement Savings Progress?

If you plan on retiring younger, you may decide to contribute more to your retirement savings each month. If you plan on working longer, you’ll have more time to save. Add the age at which you hope to retire: The average age of retirement is 62.If you don’t know this amount or don’t want to count on this income put $0. Fill in other expected income : In this cell, add the monthly total of any other expected income, such as pension or Social Security benefits.So, if you make $4,000 per month now, your planned retirement spending would be: Enter your planned monthly retirement spending: This can vary based on your expectations for retirement, but some financial experts recommend living on 80% of your current income.If you don’t already contribute to your retirement fund on a regular basis, enter the amount you plan to contribute moving forward. Enter how much you save for retirement monthly: In this cell, indicate how much you regularly contribute to your retirement plan on a monthly basis.If you have not yet started saving for retirement, put zero (don’t worry, with our calculator you’ll soon be well on your way!). Enter your current savings : Input your current retirement savings.Enter your pre-tax income : Fill in this cell with your annual salary before taxes.Issued by Aware Super Pty Ltd ABN 11 118 202 672, AFSL 293340, the trustee of Aware Super ABN 53 226 460 365.Our retirement savings calculator is easy to use, and provides straightforward results to help you maximize your saving efforts.

Aware Super financial planning services are provided by Aware Financial Services Australia Limited, ABN 86 003 742 756, AFSL No. You should also read our Product Disclosure Statement (PDS) and Target Market Determination (TMD) before making a decision about Aware Super.

#RETIREMENT LIVING EXPENSES CALCULATOR PROFESSIONAL#

Before taking any action, you should consider whether the general advice contained in this website is appropriate to you having regard to your circumstances and needs and seek appropriate professional advice if you think you need it. Further this website does not contain, and should not be read as containing, any recommendations to you in relation to your product. We have not taken into consideration any of your objectives, financial situation or needs or any information we hold about you when providing this general advice. This website contains general advice only.

0 kommentar(er)

0 kommentar(er)